If you’re looking for the best personal-finance planners to organize your money and reach your goals, I’ve found some top options. These planners feature user-friendly layouts, durable materials, and helpful tools like expense trackers, bill organizers, and motivational quotes. They suit different styles, budgets, and needs, from simple notebooks to deluxe organizers. Keep exploring, and you’ll find detailed insights on how each one can help you stay on track and succeed.

Key Takeaways

- Highlight planners with user-friendly layouts, goal-setting sections, and visual tools to support effective money organization.

- Focus on undated formats offering flexibility for year-round financial planning and goal tracking.

- Emphasize durable materials, portable sizes, and organizational features like pockets and stickers for long-term use.

- Include planners with comprehensive financial sections, bill trackers, and motivational elements to encourage consistent budgeting.

- Consider products that suit various budgets, styles, and user needs, from beginner to advanced financial management.

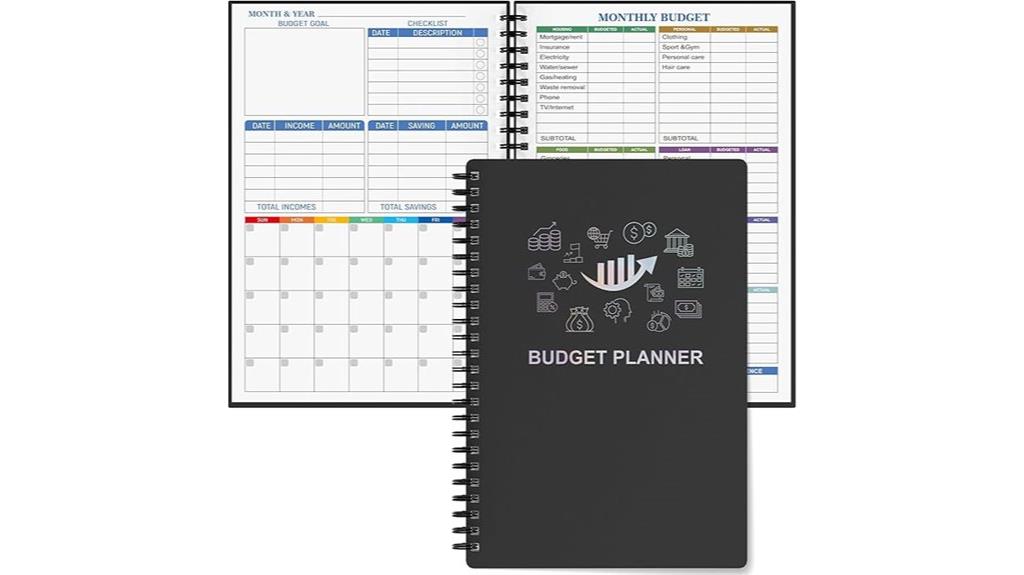

Budget Planner, Expense Tracker & Finance Organizer for 2025-2026

If you’re looking for a reliable way to stay on top of your finances in 2025-2026, this Budget Planner, Expense Tracker, and Finance Organizer is perfect for both beginners and seasoned budgeters. It consolidates income, expenses, savings, and financial goals into one organized system, making tracking straightforward. The planner features user-friendly layouts with dedicated monthly pages for setting goals, monitoring income, and planning expenses. It also includes sections for debt, bills, and savings, along with full-page calendars for important dates. Durable and water-resistant, it’s built for long-term use, helping you stay organized and confident in managing your finances.

Best For: individuals seeking a comprehensive, durable, and easy-to-use financial planning tool for 2025-2026 to manage income, expenses, savings, and financial goals effectively.

Pros:

- User-friendly layout with dedicated monthly pages simplifies goal setting and expense tracking

- Durable, water-resistant cover ensures longevity and protection against spills

- Includes full-page calendars and bonus stickers for personalized and organized planning

Cons:

- Undated format may require manual date entry each month, which can be time-consuming

- May be too comprehensive for users who prefer minimal or quick budgeting tools

- Larger size might be less portable for those seeking a compact planner

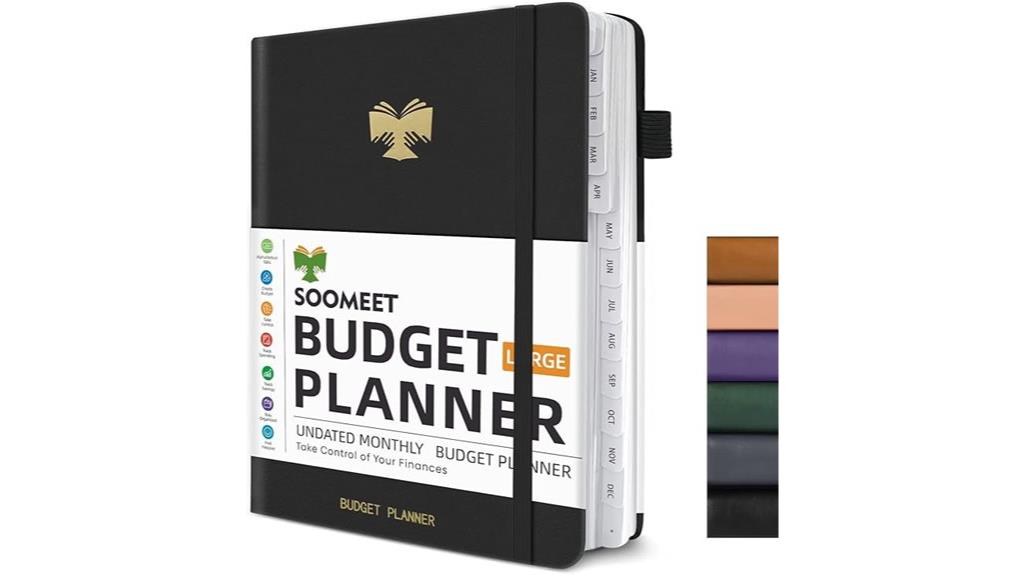

Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook

This Budget Planner and Monthly Finance Organizer is the perfect choice for anyone looking to take control of their finances with a practical, easy-to-use tool. Its undated format lets you start anytime, helping you set goals, track expenses, and review progress effortlessly. The compact size fits easily in your bag, making it convenient to carry everywhere. Crafted with high-quality paper and durable materials, it guarantees long-lasting use. With features like expense categorization, bill reminders, and monthly reviews, it encourages good financial habits and discipline—empowering you to manage your money effectively and work toward your financial goals.

Best For: individuals seeking an easy-to-use, portable tool to manage their personal finances, set goals, and track expenses effectively.

Pros:

- Undated format allows flexible starting anytime without wasting pages

- High-quality 100gsm paper prevents ink bleed and shading

- Durable polypropylene cover and metal lay-flat binding ensure longevity and ease of use

Cons:

- Compact size may limit space for detailed entries for some users

- Limited to 12-month planning, which might require additional tools for long-term tracking

- Only available in silvery cover, with limited color options

Clever Fox Budget Planner – Expense Tracker Notebook

Looking to take control of your finances with a flexible and organized tool? The Clever Fox Budget Planner is an undated expense tracker designed for monthly budgeting and goal setting. Its compact 5.8 by 8.3-inch size, vegan leather cover, and thick paper make it durable and easy to use. It includes budgeting stickers, a user guide, and features like a pen loop, elastic band, and multiple bookmarks. With dedicated pages for each month, plus savings and debt trackers, it helps you monitor progress, control spending, and build savings effectively. This planner is perfect for turning financial goals into manageable, actionable steps.

Best For: individuals seeking a flexible, durable, and comprehensive tool to organize their monthly finances, track expenses, and achieve savings or debt reduction goals.

Pros:

- Undated format allows for flexible use without worrying about losing track of dates

- Includes useful features like stickers, bookmarks, and a pen loop for enhanced organization

- Provides dedicated pages for savings and debt tracking to monitor progress effectively

Cons:

- Limited to monthly budgeting, may require additional tools for long-term financial planning

- Compact size might be less suitable for users who prefer larger writing spaces

- The vegan leather cover, while durable, may not appeal to those preferring hardcover or different materials

Soligt Budget Planner 2025-2026, Monthly Budget Book

The Soligt Budget Planner 2025-2026 is an ideal choice for anyone seeking a flexible, undated monthly budget book that can be started anytime. Its spiral-bound design, colorful pockets, and spacious pages make tracking income, expenses, savings, and bills straightforward and organized. The planner’s compact size and durable hardcover make it portable and durable, perfect for on-the-go use. Bonus features like month tabs with stickers and customizable pages enhance usability, allowing you to tailor your financial tracking. Whether you’re a beginner or experienced budgeter, this planner’s simple, visual approach helps you stay on top of your finances and reach your goals with ease.

Best For: individuals or small business owners seeking a flexible, easy-to-use, undated monthly budget planner that promotes visual tracking and organization on the go.

Pros:

- Undated format allows flexibility to start anytime during the year

- Portable size with durable hardcover and lightweight design for easy carrying

- Includes colorful pockets and customizable pages for tailored organization and tracking

Cons:

- Limited to basic budgeting features, may lack advanced financial tools

- Spiral binding may be less durable over long-term use for some users

- Paper quality, while suitable for most pens, may not handle heavy ink or markers well

ZICOTO Monthly Budget Planner, 12-Month Financial Organizer with Expense Tracker

Are you seeking a straightforward tool to stay on top of your finances without feeling overwhelmed? The ZICOTO Monthly Budget Planner offers a simple, minimalistic design that makes tracking your income, expenses, savings, and debts easy. Its undated format means you can start anytime, and its compact size fits comfortably in your bag for on-the-go use. The planner includes helpful stickers, motivational quotes, and clear instructions to keep you inspired and focused. With its practical features, this organizer empowers you to develop effective habits, review your progress regularly, and work toward financial freedom. It’s an excellent choice for anyone wanting a simple, flexible budgeting companion.

Best For: individuals seeking a simple, flexible, and portable budgeting tool to manage their finances without feeling overwhelmed.

Pros:

- Undated format allows for start at any time, offering great flexibility.

- Compact size (5.5″ x 8.3″) makes it easy to carry and use anywhere.

- Includes stickers, motivational quotes, and clear instructions to keep users inspired and engaged.

Cons:

- Minimalist design may lack advanced features found in digital budgeting tools.

- Physical planner may require manual input, which some users find less efficient than apps.

- Limited to 12 months, so long-term tracking requires additional tools or planners.

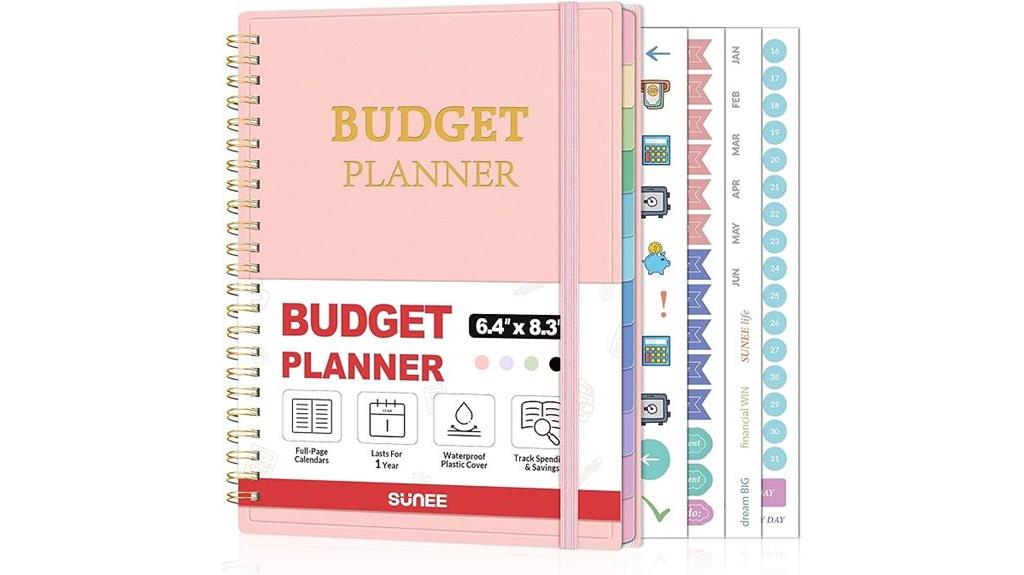

SUNEE Budget Planner with Expense Tracker and Colorful Tabs

If you’re seeking a flexible and user-friendly tool to stay on top of your finances, the SUNEE Budget Planner with Expense Tracker and Colorful Tabs is an excellent choice. Its undated design lets you start anytime, and its detailed layout covers income, expenses, savings, and goals. The colorful tabs and vibrant pages make navigation easy, while the full-page monthly calendars keep track of paydays, bills, and appointments. With features like bill trackers, debt management, and holiday budgeting, it offers everything you need to stay organized. Plus, its durable, water-resistant cover and bonus stickers make budgeting practical, engaging, and long-lasting.

Best For: individuals seeking a flexible, colorful, and comprehensive budgeting tool that accommodates their unique financial planning needs without a fixed start date.

Pros:

- Undated design allows for flexible start times and year-round use

- Vibrant, colorful tabs and pages enhance navigation and organization

- Durable, water-resistant cover and practical features like elastic bands and pockets increase longevity and convenience

Cons:

- May require some familiarity with budgeting to maximize its features

- Limited space on monthly pages might be insufficient for users with complex financial tracking needs

- The compact A5 size, while portable, may be too small for detailed note-taking or extensive data entry

Budget Planner with Monthly Tabs (7″ x 10″ Hardcover)

Looking for a reliable way to stay on top of your finances? The Budget Planner with Monthly Tabs (7″ x 10″ hardcover) is a sturdy, stylish tool designed for easy organization. Its vegan leather cover, elastic band, pen holder, and back pocket make it portable and durable. Inside, it offers sections for tracking personal finances, savings, debts, bills, and cash flow, helping you develop effective habits. Monthly tabs and reflection pages support goal setting and review, ensuring continuous progress. With extensive tracking, clear categories, and a satisfaction guarantee, this planner is perfect for anyone aiming to master their money and stay motivated throughout the year.

Best For: individuals seeking a durable, stylish, and comprehensive tool to organize and track their personal finances, savings, debts, and expenses throughout the year.

Pros:

- Durable vegan leather cover with added features like elastic band and pen holder for portability.

- Extensive sections for personal finance management, goal setting, monthly review, and annual summaries.

- Thick 100gsm no-bleed paper ensures durability and a high-quality writing experience.

Cons:

- The 7″ x 10″ size may be bulkier compared to smaller planners, potentially less portable for some users.

- May require a dedicated time commitment for monthly reflection and review pages.

- The hardcover and features might come at a higher price point compared to simpler planners.

Monthly Bill Payment Checklist and Budget Planner Notebook (8″ x 10″, Green)

The Monthly Bill Payment Checklist and Budget Planner Notebook (8″ x 10″, Green) is perfect for anyone who wants to stay organized and on top of their finances. With 128 pages and space to track income, expenses, savings, debt, and bills over 48 months, it simplifies managing your money. The detailed bill tracker includes sections for due dates, amounts, and payment status, helping you avoid missed payments. Its durable waterproof cover and large layout make it practical and easy to use. Whether for personal use or small business management, this planner keeps your financial goals clear and accessible, reducing stress and improving your budgeting habits.

Best For: individuals or small business owners seeking a durable, organized, and comprehensive tool to manage and track their monthly bills, expenses, and financial goals over multiple years.

Pros:

- Features a large 8″ x 10″ layout with 128 pages for detailed and spacious record-keeping.

- Waterproof PVC cover and thick, no-bleed paper ensure durability and ease of use.

- Supports long-term financial planning with space to track 48 months of income, expenses, savings, debt, and bills.

Cons:

- The sizable 8″ x 10″ format may be less portable for on-the-go use.

- Limited to 128 pages, which might require additional planners for extended tracking beyond 48 months.

- Design may not appeal to those preferring digital or minimalist budgeting tools.

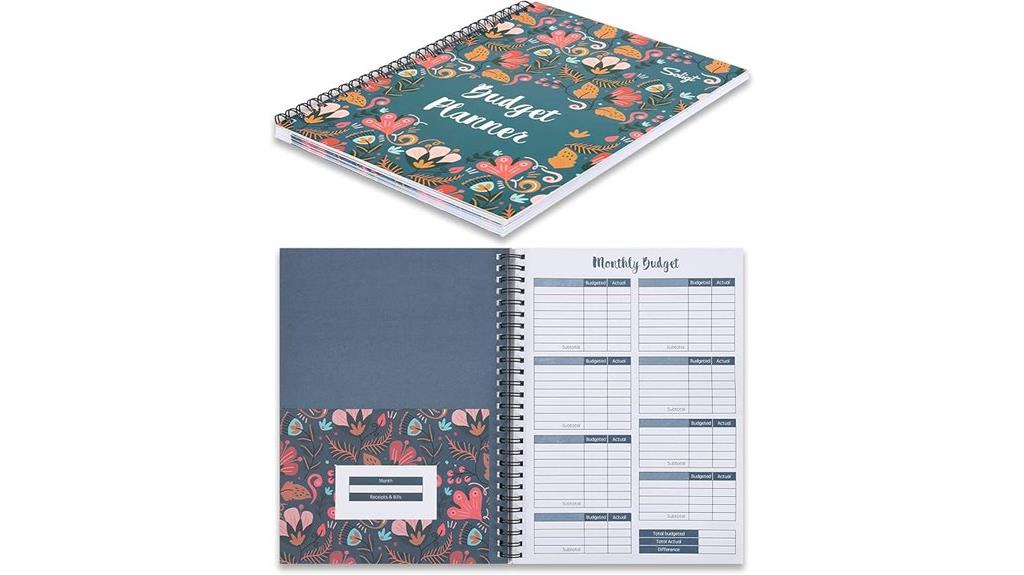

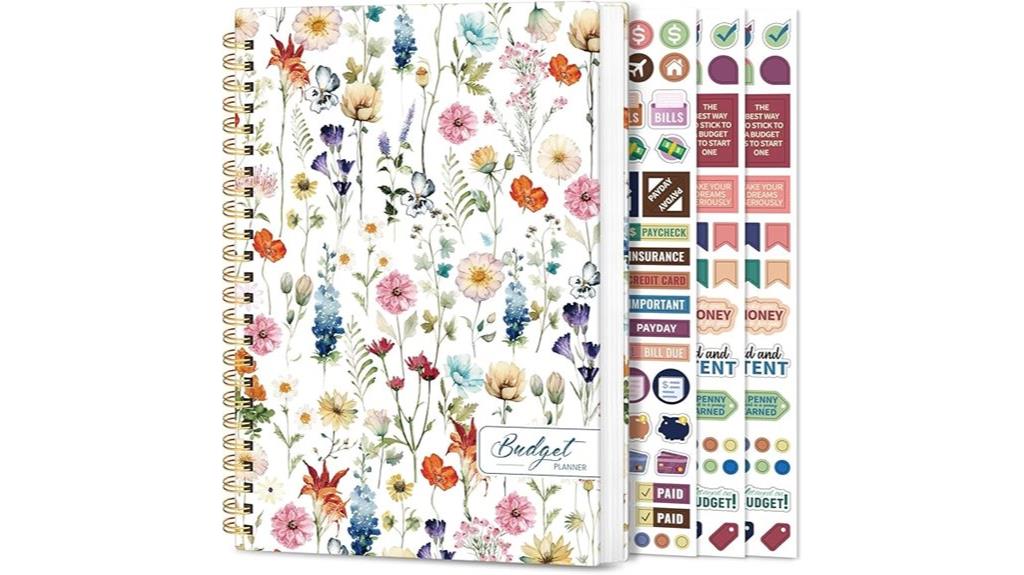

Aesthetic Budget Planner with Expense Tracker and Colorful Wildflowers Pattern

Designed with visual appeal in mind, the Aesthetic Budget Planner with Expense Tracker and Colorful Wildflowers Pattern is perfect for anyone who wants to enjoy organizing their finances while adding a touch of beauty to their daily routine. Its vibrant wildflower cover and colorful design make budgeting more enjoyable. The planner features full-page monthly calendars, expense tracking, bill management, and sections for goals, debt, and savings. It’s durable, water-resistant, and includes elastic bands, pockets, and stickers for customization. With a helpful guidebook and high customer ratings, it’s a stylish, practical tool to keep your finances organized and motivate you to reach your financial goals.

Best For: individuals seeking a visually appealing, durable, and comprehensive budgeting planner to manage their finances with ease and style.

Pros:

- Attractive colorful wildflowers design that makes budgeting more enjoyable

- Includes practical features like expense tracking, bill management, and goal setting sections

- Durable, water-resistant cover with additional accessories such as elastic bands, pockets, and stickers

Cons:

- Not undated, requiring users to manually update the planner each year

- Slightly heavy at 15.5 ounces, which may be less convenient for portability

- Limited to one style and pattern, which might not suit all aesthetic preferences

Bill Payment Tracker Notebook with Pocket

If you’re someone who wants a reliable way to stay on top of your bills without carrying bulky planners, the Bill Payment Tracker Notebook with Pocket is perfect. Its compact A5 size easily fits in your bag, making it ideal for on-the-go use. The waterproof cover and sturdy binding guarantee durability, while the back pocket offers space for receipts or notes. With 112 undated pages, you can record bill details, due dates, payments, and balances systematically. The built-in calendar and holiday planner help you schedule payments around busy times, preventing late fees. It’s a simple, efficient tool to keep your finances organized and bills paid on time.

Best For: individuals seeking a portable, durable, and organized way to track and manage their bills and expenses on the go.

Pros:

- Compact size fits easily into bags for portability and convenience.

- Waterproof cover and sturdy binding ensure durability and long-term use.

- Undated pages allow flexible recording without frequent replacements.

Cons:

- Limited to 112 pages, which may require periodic replacement for extensive use.

- Lacks digital features for those preferring electronic financial management.

- The small size might be challenging for users who prefer larger writing spaces or detailed entries.

Current The Best Days Bill Paying Organizer Book

For anyone seeking a straightforward way to stay on top of bill payments, Current The Best Days Bill Paying Organizer Book stands out as an ideal solution. This 9″ x 12″ spiral-bound organizer offers 14 spacious pockets, 32 label stickers, and a monthly finance tracker, making it easy to manage bills, track expenses, and stay organized. Its durable construction with thick paper and a coated cover guarantees longevity, while the ample space for notes and receipts keeps everything accessible. Made in the USA and available in stylish designs, it transforms bill management into a less stressful, more manageable routine. It’s a practical tool for anyone wanting order and clarity in their finances.

Best For: individuals seeking an organized, durable, and stylish solution to manage bill payments and personal finances at home or in the office.

Pros:

- Spacious design with 14 large pockets for easy document storage

- Includes 32 label stickers for clear categorization and organization

- Durable construction with thick paper and coated cover for long-term use

Cons:

- Size (9″ x 12″) may be bulky for small or cluttered spaces

- Limited to bill management; not designed for comprehensive financial planning

- Styles and designs are attractive but may not suit all personal tastes

Clever Fox Budget Planner & Monthly Bill Organizer

The Clever Fox Budget Planner & Monthly Bill Organizer stands out as an ideal choice for anyone seeking a thorough and durable tool to manage their finances efficiently. Its 8×9.5-inch size fits comfortably on a desk or shelf, featuring a sturdy eco-leather cover and spiral binding for longevity. With thick 120gsm paper, it’s designed for smooth writing, and includes helpful extras like budgeting stickers, a user guide, and a keepsake gift box. The 12 laminated bill pockets keep bills organized, while monthly planning pages help track expenses, set budgets, and review progress. It’s a all-encompassing, stylish solution for staying on top of your financial goals.

Best For: individuals seeking a comprehensive, durable, and stylish tool to efficiently manage household and personal finances with goal-setting capabilities.

Pros:

- Durable eco-leather cover and thick 120gsm paper ensure longevity and smooth writing experience.

- 12 laminated bill pockets provide organized storage for bills and financial documents.

- Includes budgeting stickers, user guide, and keepsake gift box, adding value and ease of use.

Cons:

- Slightly larger size may take up more space on desks or shelves.

- Spiral binding might make it less flexible for compact storage.

- May require regular user engagement to fully utilize all features and achieve financial goals.

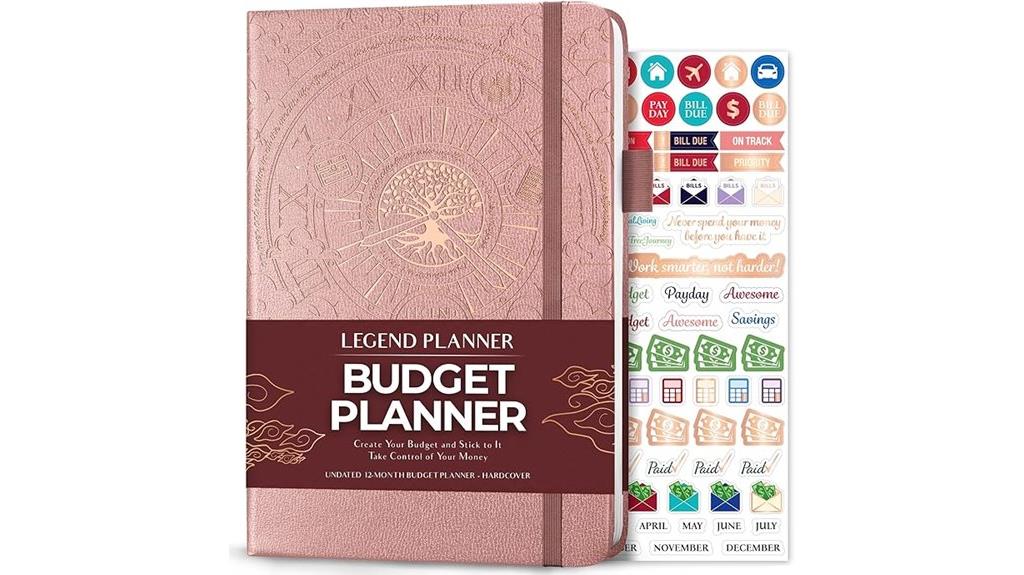

Legend Budget Planner Deluxe Financial Organizer & Expense Tracker Notebook

Designed for anyone seeking a thorough and stylish way to manage their finances, the Legend Budget Planner Deluxe Financial Organizer is an excellent choice. Its rose gold foil accents and vegan leather cover add elegance, while the thick 120gsm paper guarantees durability. This planner features monthly sections with calendars, budget pages, expense trackers, and review spaces to monitor your progress. It includes tools like savings and debt trackers, holiday budgets, and bill trackers, helping you stay on top of your financial goals. With lay-flat binding, bookmarks, stickers, and a user guide, it’s both functional and refined—making money management organized and even enjoyable.

Best For: individuals seeking a stylish, comprehensive, and durable financial organizer to effectively manage budgets, savings, and debt tracking.

Pros:

- Elegant rose gold foil accents and vegan leather cover enhance aesthetic appeal and durability.

- Includes a variety of financial tools such as savings trackers, debt trackers, and bill trackers for comprehensive money management.

- Features lay-flat binding, thick 120gsm paper, and additional accessories like bookmarks and stickers for ease of use and customization.

Cons:

- Slightly heavier at 12 ounces, which may be less convenient for portability.

- Limited to 60-day money-back guarantee, which might not cover long-term concerns.

- May require familiarity with financial planning to maximize the planner’s features effectively.

Factors to Consider When Choosing Personal‑Finance Planner Books

When choosing a personal-finance planner book, I focus on the budgeting features that suit my needs and how easy it is to use daily. I also consider the design, durability, and whether the size makes it portable enough for my lifestyle. These factors help me find a planner that’s both functional and convenient to keep up with my financial goals.

Budgeting Features Needed

Are you selecting a personal-finance planner book that truly supports your budgeting needs? Look for a planner with dedicated sections for setting financial goals, tracking income, and monitoring expenses. These features help you stay organized and give a clear overview of your financial health. Additionally, check if it includes bill payment logs, debt trackers, and savings goal pages to make detailed management easier. Flexibility is key, so verify if the planner offers space for regular reviews and adjustments, ensuring your budget remains accurate over time. Visual tools like calendars, charts, or stickers can boost engagement and clarity. Finally, consider whether the planner is undated or flexible, so you can start anytime and use it long-term without restrictions.

Ease of Use

Choosing a personal-finance planner that’s easy to use starts with a clear and intuitive layout. I look for planners with straightforward navigation and quick access to sections like goals, expenses, and savings. Guided instructions, prompts, or tips can be a game-changer, especially if I’m new to budgeting. An undated format also adds flexibility, letting me start anytime without fussing over dates. Features like visual aids—charts, checklists, or graphs—make tracking my finances simpler and more engaging. Durability matters too; a sturdy binding and practical size make it easier to handle daily tasks. User-friendly fonts and a comfortable layout help me stay organized without frustration. Overall, ease of use keeps me motivated and ensures I stick to my financial goals.

Design and Aesthetics

A personal-finance planner’s design and aesthetics play a significant role in how motivated I feel to use it regularly. A visually appealing cover, thoughtful color schemes, and a cohesive overall look make the planner inviting. An organized layout with clear headings and intuitive sections helps me easily track and review my finances without frustration. Customizable features like stickers, tabs, and decorative elements let me personalize my planner, making it more engaging and reflective of my personality. The choice of durable covers and high-quality paper not only enhances its aesthetic appeal but also guarantees it lasts. When a planner looks attractive and feels personalized, I’m more inclined to use it consistently, turning money management into a positive and motivating experience.

Durability and Material Quality

When selecting a personal-finance planner, prioritizing durability and material quality is essential because these factors directly impact how long the planner will last through everyday use. High-quality materials like thick, bleed-proof paper prevent ink from smudging or bleeding through, keeping your pages neat. A sturdy cover, especially water-resistant ones, protects against spills and daily wear, extending the lifespan of your planner. Durable binding methods such as lay-flat or spiral bindings help prevent pages from tearing or falling out over time. Using premium materials like vegan leather or polypropylene adds to its longevity and gives a professional look. Reinforced edges and thick pages further reduce fraying and damage, ensuring your planner remains intact even with frequent handling.

Size and Portability

The size and portability of your personal-finance planner can considerably affect how easily you incorporate it into your daily routine. Choosing a size that fits comfortably in your bag or pocket makes it simple to carry everywhere. Smaller options like A5 or compact notebooks are ideal for quick access and on-the-go use. Larger planners offer more space for detailed entries but can be cumbersome to transport regularly. Lightweight materials and slim designs enhance portability without sacrificing function, making it easier to keep your financial goals in sight. Features like elastic bands and built-in pockets add to convenience, keeping everything secure and organized. Ultimately, selecting a size that balances space and portability helps guarantee you stay consistent with your planning efforts.

Additional Planning Tools

Choosing the right personal-finance planner involves considering extra features that boost its usefulness. Goal-setting pages, debt trackers, and savings logs help me stay focused and monitor progress. Full-page calendars and bill payment checklists make it easier to manage due dates and expenses without stress. Visual aids like stickers, motivational quotes, and color-coded sections keep me engaged and motivated to stick with my financial habits. Additional tools such as pocket storage for receipts or notes, and dedicated sections for long-term goals, improve organization and quick access to important info. Including resources like user guides or strategy pages provides valuable education, helping me make better financial decisions. These extra features transform a simple planner into a thorough tool that supports my financial success.

Price and Value

Ever wondered if you’re getting the best value for your money when selecting a personal-finance planner book? Comparing prices helps you avoid overspending and guarantees your purchase fits your budget. It’s important to evaluate the features and content offered relative to the cost—does the planner provide enough tools and guidance for your financial goals? Check reviews and ratings to see if the quality, durability, and usefulness match the price. Be mindful of extra costs like accessories or refill pages that can add up. Sometimes, a higher-priced planner offers unique features or premium materials that justify the expense, but more affordable options can also be effective if they meet your needs. Balancing price and value helps you make a smart, satisfying choice.

Frequently Asked Questions

How Do I Choose the Best Planner for My Financial Goals?

To choose the best planner for my financial goals, I start by clarifying what I want to achieve—saving, investing, or budgeting. Then, I look for a planner that offers customizable sections, easy-to-use tracking tools, and motivational features. I also check reviews to see if others found it helpful. Most importantly, I pick one that feels intuitive and inspiring so I stay committed to my financial journey.

Can These Planners Accommodate Irregular Income Streams?

Think of these planners like adaptable maps—they can handle irregular income streams. I once had a freelance gig with unpredictable pay, and I used a planner that let me track varying income sources and set flexible budgets. These planners often include sections for fluctuating income, helping you plan smarter. So yes, many are designed to accommodate irregular earnings, making it easier to stay on top of your financial goals.

Are Digital or Printable Planners More Effective Than Physical Books?

I find digital or printable planners more effective because they offer flexibility and customization that physical books can’t match. I can easily update my budget, add notes, or adjust goals on my device, making planning more dynamic. Plus, printable options let me tailor pages to my needs, and I can carry or access them anywhere. However, it’s all about what suits your style best, so try both to see which works for you.

How Often Should I Review and Update My Financial Planner?

I review my financial planner at least monthly to stay on track and make adjustments as needed. I also do a more thorough update quarterly, checking my goals, budgets, and progress. This routine keeps me accountable and guarantees I’m adapting to any changes in my finances or priorities. Regular reviews help me stay focused and motivated, so I recommend setting a consistent schedule that works for you.

Do These Planners Include Tools for Tracking Investments and Debt?

Yes, many of these planners include tools for tracking investments and debt. I find that having dedicated sections or charts helps me stay on top of my investment performance and debt reduction progress. These features make it easier to visualize my financial health, set goals, and adjust strategies as needed. If you’re serious about managing every aspect of your finances, look for planners with all-encompassing tracking tools.

Conclusion

Just like Robin Hood aimed to balance the scales, choosing the right personal-finance planner can help you take control of your money and reach your goals. Whether you prefer a detailed expense tracker or a simple monthly overview, these books are your trusty quivers in the archery of financial success. So, pick one that speaks to you, and start your journey—because, in the end, your financial future is yours to craft.